Please wait while you are redirected...or Click Here if you do not want to wait.

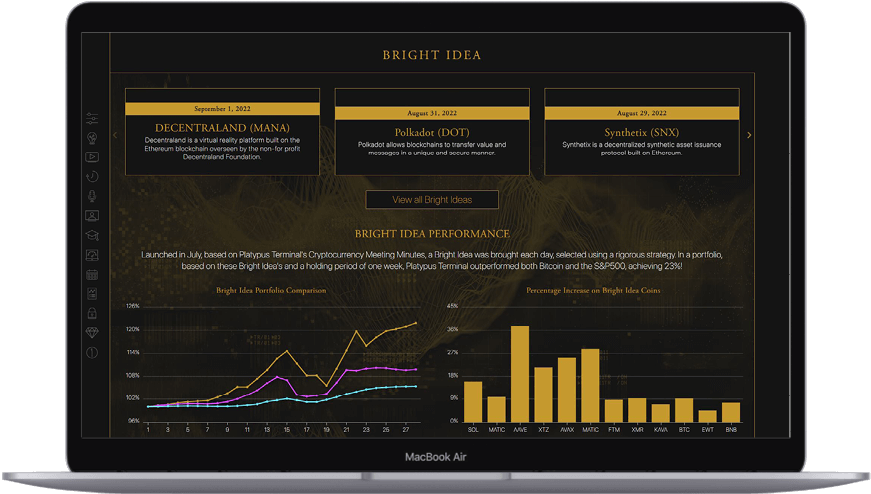

Coin: Aave (AAVE)

Aave was launched in 2017 on the Ethereum network and was one of the first lending based platforms

Twitter Sentiment

| Positive | Neutral | Negative |

|

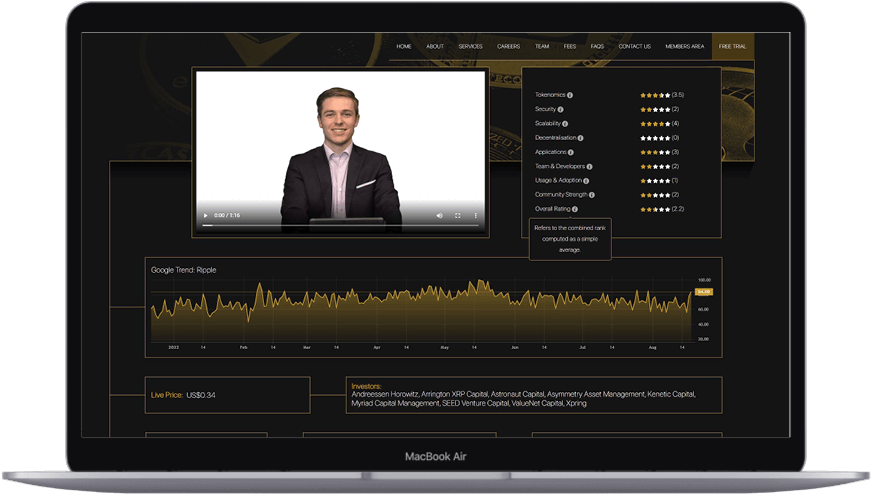

Tokenomics

|

|

|

Security

|

|

|

Scalability

|

|

|

Decentralisation

|

|

|

Applications

|

|

|

Team & Developers

|

|

|

Usage & Adoption

|

|

|

Community Strength

|

|

|

Overall Rating

|

Investors:

Blockchain Capital, Blockchain.com Ventures, DTC Capital, Defiance Capital, Framework Ventures, ParaFi Capital, Standard Crypto, Three Arrows Capital

|

|

|

Disclaimer: Platypus Terminal does not provide any investment advice, nor is anything mentioned an offer to sell, or a solicitation of an offer to buy any security or other instrument. Under no circumstances should investments be based solely on the information provided. We do not guarantee the security or completeness of our information, and are not held liable.

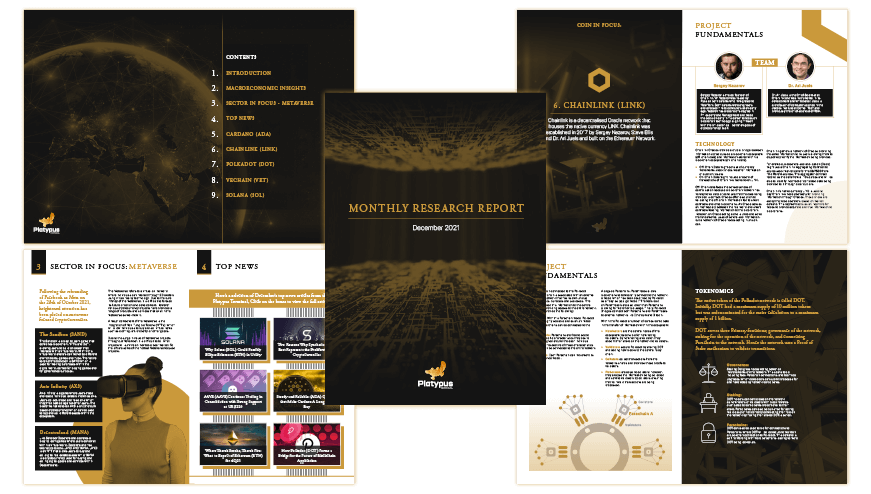

Aave was fouded by Stani Kulechov, a Finnish programmer who was first exposed to the powers of decentralised finance at university. Initially, the protocol was known as Ethlend but was rebranded Aave, a Finnish word that translates to “ghost” in English. Aave provides an open and decentralised borrowing and lending market for a variety of asset classes. This is a truly decentralised financial service offering products typically provided by Banks.

Aave’s V2 upgrade in late 2020 has added to the protocol’s product offering with collateral swapping, Credit Delegation and Batched Flash loans. The native token of Aave is the Aave token which has a max supply of $16 million. The token is predominantly used to gain voting rights on governance-related matters, transaction fee’s and to incentivize liquidity providers. Coverage of Aave is brought to you by Platypus Terminal.

Similar coins

COMPOUND

COMPOUND

COMPOUND

KAVA

KAVA

KAVA

SYNTHETIX

SYNTHETIX

SYNTHETIX

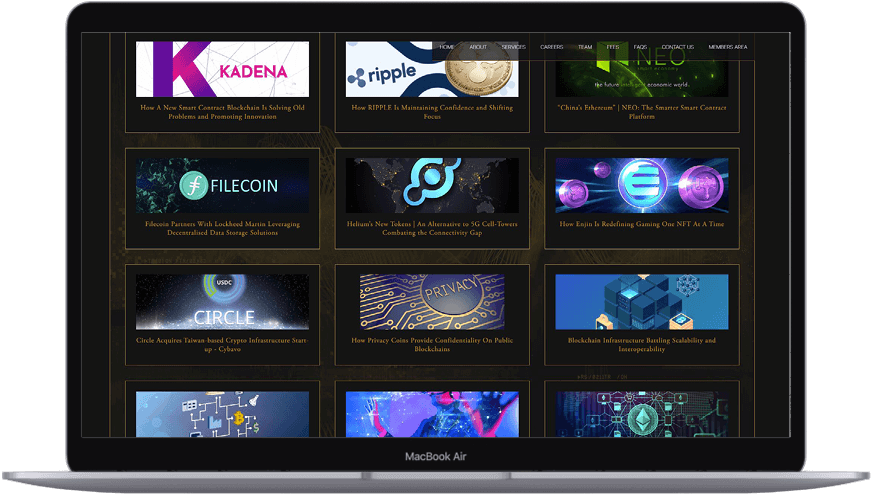

Articles related to Aave (AAVE)

AAVE Votes to Create Overcollateralized Stablecoin