Frequently Asked Questions

Below you’ll find answers to the questions we get asked the most. If your answer isn’t covered here, please contact us.

Frequently Asked Questions

Below you’ll find answers to the questions we get asked the most. If your answer isn’t covered here, please contact us.

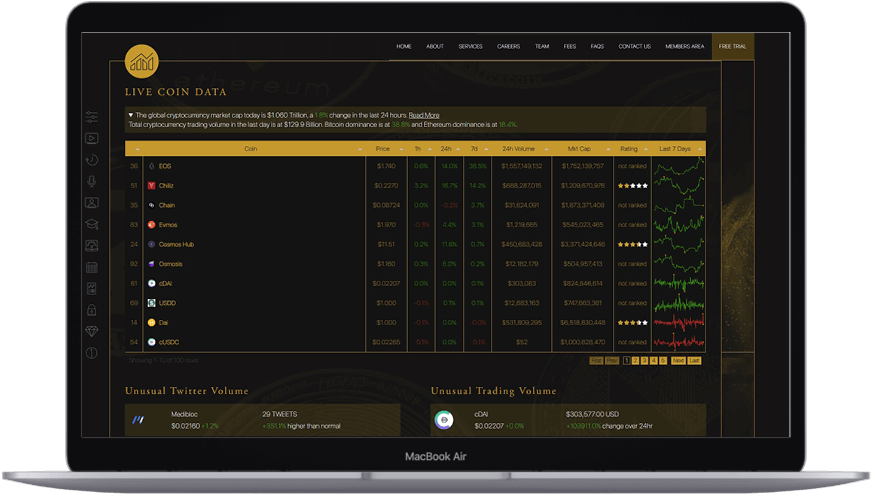

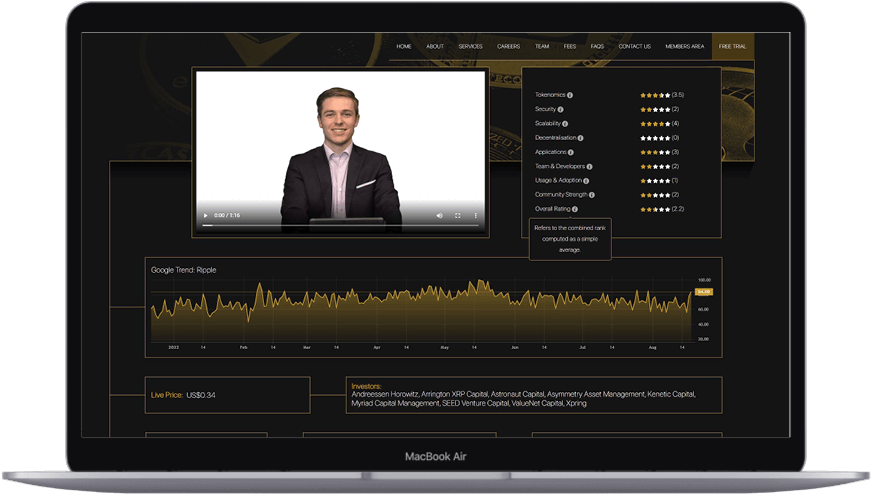

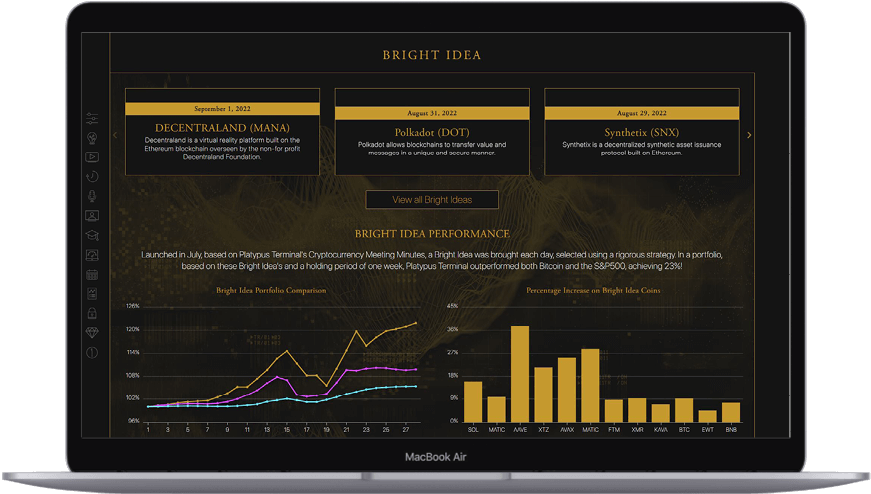

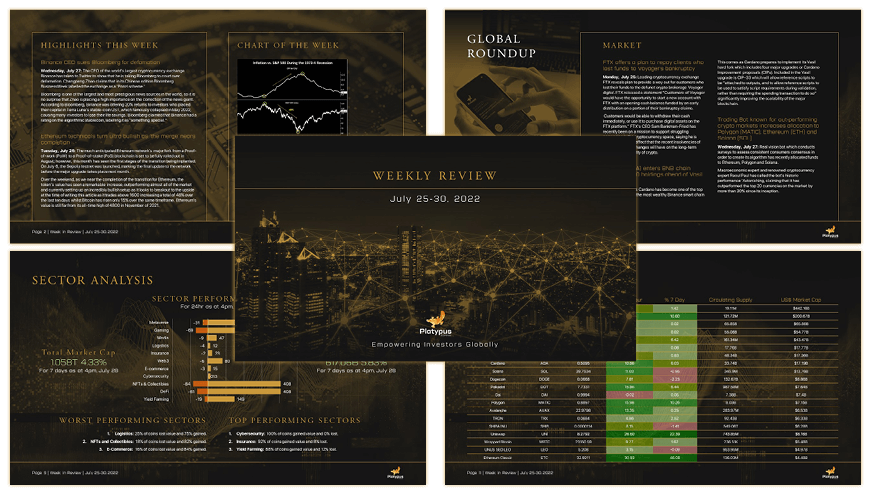

Platypus Terminal is a leading cryptocurrency platform, providing unique AI driven data, intelligence, time sensitive information and cutting-edge information, as well as resources and education to better navigate the cryptocurrency markets. The team consists of Data Scientists, Software Engineers, Mathematicians, Research Analysts and Traders, who analyse top performing crypto projects and monitor markets daily.

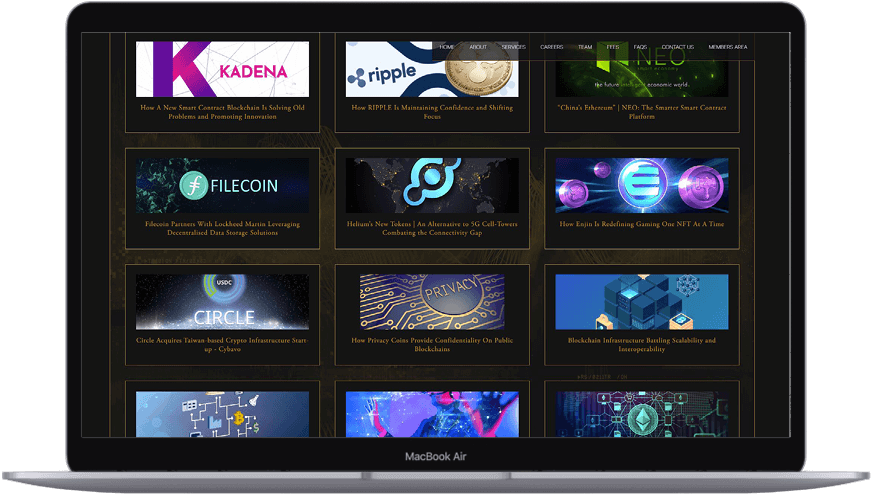

Platypus Terminal provides a range of educational resources such as education videos, shows, interactive multiple-choice quizzes and an extensive crypto dictionary. These educational video and resources cover topics such as Blockchain, Bitcoin, Staking, Metaverse, Mining, NFT’s, Technical Indicators and more.

Platypus Terminal offers a complimentary demo here. A representative will walk you through and provide access to Coin Data & Insights, Coin Ratings, AI Driven Search Engine & Social Media Data, Daily Market Wrap, Daily News Articles, Daily Cryptocurrency Meeting Minutes, Bright Idea, Filtering Tool, Weekly Review Report, Monthly Report, Educational Videos & Content, the Platypus Show & Expert Insight Interviews.

We accept Visa, Mastercard, American Express and Bitcoin. Your subscription will automatically renew each year unless cancelled during the subscription period.

At the conclusion of a 48-hour free trial to continue accessing our resources you will have the option of joining. Learn more about the services here, or speak to a representative.

The Platypus Terminal Titanium Membership is invitation only and limited to 100 members globally, offering the most exclusive crypto community in the world, with monthly gatherings of selected high-profile figures, leading crypto advocates and investors. Currently we are currently taking applications for 2025 via email through titanium@platypusterminal.com.

See more information about the Titanium Membership here.

At Platypus Terminal we are on a mission to revolutionize the industry and create the largest crypto community of investors and pioneering blockchain projects. We want to encourage you to build the community with us through our exclusive partner program. Apply here!

Platypus Terminal offer a 14 day money back guarantee and after that cooling off period unfortunately no refunds will be given.

Platypus Terminal does not provide investment advice, and anything mentioned throughout all written and video content is not an offer to sell or a solicitation of an offer to buy any security or other financial instruments.

To cancel your subscription to the Platypus Terminal, navigate to ‘Account’ on the search tab on the left side of the Members Area homepage. Then select ‘Subscriptions’ to make adjustments.

If you are logged into the Platypus Terminal select ‘Account’ on the search tab on the left side of the Members Area homepage. Then select ‘Change Password,’ and follow the necessary prompts.

If you have forgot your password, select ‘Members Area’ on the Platypus Terminal homepage. Then select ‘Forgot Password,’ and follow the necessary prompts.

To update or change your account details navigate to ‘Account’ on the search tab on the left side of the Members Area homepage. Under the ‘Home’ tab, enter your details and select ‘Save Profile’.

If the above FAQ’s do not assist with your enquiry, please contact a representative here.

A Blockchain is a permanent, immutable, and publicly available database of information following a series of digital events over time. These digital events are chained together chronologically in blocks and are often secured so that the chain of blocks can never be manipulated, hacked or deleted. Blockchain was introduced and popularised by the anonymous creator of Bitcoin Satoshi Nakamoto, who used Blockchain technology as a ledger for transaction of the digital currency Bitcoin. Blocks on the Bitcoin blockchain contain three key pieces of information: A Hash, the Hash of the previous block and transaction data. A Hash is a unique identification number for each block which confirms its order on the blockchain using the Hash of the previous block. Finally, transaction data such as the senders address, receivers address, and transaction amount are also recorded. Blockchains have a variety of real-world applications including:

- Acting as a ledger for transactions for digital currency’s such as Bitcoin.

- Transparent and accurate supply chain management for goods tracking.

- Secure and tamperproof Digital Identification.

- To store digital records of patients.

- To record and save immutable wills or inheritances.

- To track the origins and contents of packaged food for safety reasons.

- Secure and fraudulent free digital voting.

- To tokenise the purchase and records of Real Estate.

- Secure and efficient data sharing.

Any asset derives its value through the fundamental principle of supply and demand. Two parties will meet and transact assets based on the value they individually subscribe to them. This is combined with the collective trust that the surrounding economic system also recognises and trusts the value a currency or commodity has.

For example, a five dollar note in Australia is essentially a piece of plastic, however an individual recognises it has value because Cryptocurrencies operate in the same way, with a network of the currency’s users collectively recognising the value of a coin or token. This value can be determined by a range of measures including:

- The real-world application and functionality of a cryptocurrency and the blockchain in which it operates will drive demand in the long run. For example, Ve-Chain is one of the world’s largest supply chain management blockchains, a technology which is expected to have worldwide adoption.

- How likely is the use of the currency by a wide and growing market and are their major corporations or institutions backing its use? For example, BitTorrent’s demand is driven by a community of over 100 million monthly active users and partnerships with the likes of Huawei, Netflix and Facebook.

- An important factor when valuing a cryptocurrency is analysing a token or coins economics or tokenomics. Tokenomics focuses on the supply side factors that will influence the value of a currency. For example, Bitcoin has a maximum supply of 21 million tokens, giving it a scarcity value. Over time, greater demand for a limited supply will raise the price.

The publication of the Bitcoin Whitepaper in 2008 by Satoshi Nakamoto can be seen as the advent of the Cryptocurrency. This Whitepaper induced the world to the power of blockchain technology and its potential to revolutionise the current financial system. The Whitepaper outlines how “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.” The origin of Bitcoin lies in this very intention to bypass third party financial intermediaries that profit from the mediation of financial activities.

The early days of Bitcoin saw the currency being used for anonymous transactions over the dark web. The notorious website Silk Road sold narcotics, weapons and other illegal goods on the website accepting Bitcoin as a primary form of payment due to its anonymity. The founder of Silk Road Ross Ulbricht was convicted in 2015 for money laundering, computer hacking and conspiracy to traffic narcotics and given two life sentences. Over the years, Bitcoin was accepted as a form of donation for organisations such as the Electronic Frontier Foundation and WikiLeaks. In 2012, it also found its way on to CNBC’s Mad Money program where it was labelled ‘not a true currency.’ In 2013, the Bitcoin payment processor and Exchange Coinbase reportedly sold $1 million in bitcoin at over $22 apiece. Throughout this period new projects began to emerge such as Litecoin and Namecoin in 2011, Peercoin in 2012 and Ripple and Dogecoin in 2014 slowly giving exposure to the growing industry.

The term Alt Coin, or Alternative Coin, is used to describe any Cryptocurrency that is not Bitcoin. Each Cryptocurrency and their associated project have individual use cases and economics. Some of the most exciting Alt Coins projects include:

- Ethereum is an open source Blockchain Network providing access to decentralised applications through smart contract compatibility and its unique coding language, Solidity. The native currency to Ethereum is Ether.

- Cardano is a third-generation Cryptocurrency aiming to achieve superior scalability, interoperability and sustainability through decentralised applications, smart contract compatibility and its unique proof of stake algorithm called Ouroboros. The native currency to Cardano is Ada.

- Polkadot is a shared Blockchain protocol allowing cross-network functionality and communication between existing blockchains to eliminate the fragmented world of Cryptocurrencies. The native currency to Polkadot is Dot.

- Polygon (previously known as Matic Network) aims to be Ethereum’s internet of blockchains providing a solution to interoperability, scalability and security using plasma chains. The native currency to Polygon is Matic.

- Ripple is a leading payments solutions provider leveraging and integrating the power of blockchain technology in our current financial system, primarily focused on cross border transactions. The native currency of Ripple is XRP.

- Solana is a decentralised application and smart contract compatible platform that uses a unique Proof-of-History Census mechanism and Tower Byzantine Fault Tolerance to achieve extremely high transaction speeds with extremely low transaction costs. The native currency of Solana is the Sol token.

- Terra provides a decentralised blockchain based exchange for fiat pegged stable coins allowing users to send cross border payments using a variety of currencies. The native currency of Terra is the Luna token.

- VeChain leverages blockchain technology to provide supply chain management solutions to physical businesses. VeChain operates a Dual token ecosystem of VeChain Token and VeChain Thor Token.

A cryptocurrency wallet is a digital wallet that allows you to interact with a specific blockchain. Contrary to popular belief these wallets don’t actually hold any currency, but provide digital access for an individual to communicate with the blockchain.

These three tools provide a user with access to their funds, a location for new funds to be sent and identifies them as the rightful owner of the currency. Wallets can be described as either Hot or Cold:

- Hot wallets are connected to the internet and are often accessed by a wallet provider or Cryptocurrency exchange. Hence, hot wallets are less secure, but easier to use and operate. Hot wallets can be separated into Web Wallets, Desktop Wallets and Mobile Wallets.

- Cold wallets are not connected to the internet therefore they are more secure using a physical means to hold wallet information. Cold wallets can come in the form of purpose-built hard drives or paper wallets using physical QR codes.

Proof of Stake and Proof of Work are both consensus mechanisms used to approve the entry of data onto a blockchain. A consensus mechanism uses the input and agreement on a data entry from a network of users to confirm the validity of a data entry. This process of extremely important in ensuring the data entered onto a blockchain is a true representation of events and uncorrupted.

Proof of Work Consensus is operated by nodes on the network through the computation of complex mathematical problems by an algorithm. The reward for finding the answer to this problem is the right to validate the next block on the blockchain. Often the node is also rewarded with coins or tokens for contributing to the network’s operation. The faster a node solves these mathematical problems, the more likely they are to be awarded the right to validate blocks. The speed in which a node does so is directly proportional to the power of the equipment they are operating.

Proof of Work Consensus instead assigns the right to validate blocks on the blockchain proportional to the amount of the native coin or token being staked. For example, a the node with 10% of the total staked coins will process roughly 10% of total transactions and rewarded through either newly minted coins or transaction fees being charged on the network.

Staking is the process of participating in the Proof of Stake (PoS) validation process of a specific blockchain.

Today’s economic and financial system is highly centralised, meaning that central institutions have significant control and influence of its management and operation. Each country is bound by its own currency with a central bank dictating its issuance and a small number of large financial institutions facilitating borrowing, lending, insurance and other financial services. These central bodies are prone to mismanagement, fraud and corruption, and profit from existing third-party intermediaries.

De-Fi is an abbreviation for Decentralised Finance, a concept whereby centralised third parties in a financial system are no longer required. Cryptocurrencies and Blockchain technology provide the infrastructure for many financial services to be offered without third parties. These financial services are enforced by code and conduct peer to peer recorded activity on the blockchain. Examples of decentrlaised finance include:

- Decentralised exchanges whereby Cryptocurrencies are bought and sold peer to peer without an intermediary. Blockchain technology can connect users through pools of buyers and sellers and enforce transactions using code.

- Decentralised Money markets connects borrowers and lenders through pools of funds. Cryptocurrency, coins or tokens can then be deposited as collateral against loans. Again, all enforced by code.

An asset is Fungible if it is mutually interchangeable, such as a $100 note or a singular bitcoin; one is identical and holds the same value as another. An asset being Non-Fungible means it is totally unique and one of a kind. A Non-Fungible token or NFT is a collection of data stored on a blockchain that can represent a variety of digital files. This data might be a photo, video or piece of music and is made completely distinct and easily verifiable. In essence, once created, an NFT is virtually impossible to duplicate or replicate making forgery of original pieces impossible. This is unlike forging dollar notes, baseball cards or rare artwork. Due to their Nonfungibility NFT’s cannot be directly exchanged with one another and are bought and sold in an open marketplace. The majority of NFT’s are built and traded on the Ethereum Network and like regular coins or tokens can be held in a wallet. Other characteristics include:

- Non-Interoperability: if NFT’s can be used they will have a specific use case. For example, a playing card NFT from one game cannot be used in another game.

- Indestructible: they cannot be destroyed.

- Verifiable: NFT’s can be individual traced back to their creation.

Bitcoin provides a decentralised protocol to replace the financial intermediaries of our current financial system. Intermediaries such as central banks, control and determine the flow of capital within this system. Bitcoin avoids this centralisation by allowing anybody to take part in the maintenance of the system. To do so you must become a node on the Bitcoin Blockchain.

As a node your computer solves complex algorithms to a unique pin number known as a hash that allows blocks to be added to the blockchain. The more powerful the computer and the more physical energy/electricity it can sacrifice, the faster the algorithms are solved. By expending this computational power to solve the Hash key and add blocks to the Blockchain you are rewarded with Bitcoin. This means that the more computational power expended by a node the more they are reward with new Bitcoins. This is the process of Mining.

It must be noted however, that the returns for contributing your mining power are only proportional to the total mining power on the entire system. Hence, the more mining power on the entire system makes making mining more difficult and the rewards harder to come by. Initially Bitcoin could be mined on a laptop computer or desktop but now it requires advanced and expensive equipment. This makes the rewards to Bitcoin mining self-adjusting, allowing the steady flow of new Bitcoin’s onto the network.

Initial Coin Offerings or ICO’s are used to raise capital from investors to facilitate the future growth of the Cryptocurrency project. Hence, ICO’s share many similarities with an Initial Public Offering (IPO) of common stock and therefore provide a crucial platform for new projects to grow and succeed.

The goals, intentions and potential of a Cryptocurrency is usually set out in the projects Whitepaper which can be seen as a business proposal, marketing tool and project roadmap for what the venture aims to achieve. Once an organisation has published its Whitepaper and minted their currency native to the network in development the ICO can begin. The capital is raised by pitching ad selling the concept to interested investors and rather than awarding investors with shares, coins are instead given out to participants. The funds raised are then used to begin or continue work on a Cryptocurrency network.

A major criticism of ICOs is the lack of regulation surrounding them and the ease in which capital can be raised. With a strong concept, good pitch and a coin on offer organisations can raise millions of dollars without having achieved anything. Some ICOs fail to live up to expectations and the project fails rendering the coins/tokens issued to investors worthless. Others are complete scams with those running the ICO having no intention to work on the project at all.